Kenyans to Sue PayPal For Unlawfully Withholding Funds

Sam Gichuru had tried to withdraw his money from PayPal for three years with no success. Then one day, they suddenly paid him with no explanation after he took to X (Twitter) to complain to his nearly 200,000 followers.

Gichuru is a well known Kenyan IT founder and investor. And by well known, we are not just talking about Nairobi – where he has founded several successful ventures – but Silicon valley, where he has met everyone from Paul Graham to former Google CTO Meghan Smith, and raised millions of investment money into the bargain.

Gichuru runs Nailab, a high profile business incubator in Nairobi, and also runs Kidato School, which uses tech to make education accessible to Kenyan children.

Thus, you would think that PayPal would have no problems verifying his identity. But that’s not the case. Instead, when a business partner sent him a meager $360, PayPal demanded additional KYC documents before they could release the money.

Not thinking much of it, Sam uploaded the documents.

But every time he added a document that PayPal had previously demanded, the “rather creative” PR and Customer Care team at PayPal came up with another demand.

After nearly three years of this unhappy charade, he finally got mad as hell and couldn’t take it anymore.

So he started a drive on Twitter to mobilize other Kenyans in the same situation as him and launch a joint lawsuit against PayPal.

“Are Kenyans still struggling to withdraw their money from @paypal? I am. It’s been over 2 years. If I get 10 people, I am happy to start a joint legal process”, he posted on X, the app formerly known as Twitter.

That tweet quickly went viral, getting over 200,000 views and 350 retweets. He followed it up with a form where interested Kenyans could sign up to join the lawsuit. To date, 243 people have signed up and at least one lawyer has expressed interest in representing them.

PayPal Refunds Sam’s Money

After Paypal noticed the momentum that Sam – whose X account has nearly 200K followers – was generating with the issue, they suddenly unlocked the money and released it to him; but not after making unauthorized deductions.

This is a familiar tactic that PayPal uses to remove people from becoming plaintiffs. If they pay you, you cannot sue them for withholding your money. However, as Gichuru told Kenyan Foreign Policy, the tactic won’t work because he won’t let PayPal off the hook.

“They damaged me by withholding my money for three years and unlawfully earning interest from it “, he says. In addition, PayPal released the funds after making deductions that they shouldn’t have, by his reckoning. As far as he is concerned, that email from PayPal is an admission of guilt and he is urging fellow Africans to join his petition.

Indeed, Kenyans are fairly litigious and they have experience suing other BigTech companies in Kenyan courts. PayPal has also been sued in the US for withholding customer funds and there is currently a website dedicated to users who want to join the action against PayPal in the US.

When Kenyan blogger Maina Ndegwa was told by PayPal that he has to wait for the dreaded 180 days before he can get his money from his PayPal account, he decided he is not willing to wait that long.

A frustrated Ndegwa took to his Facebook page and posted to his 96,000 followers “PayPal is the worst .Not for Kenyans”. Within a short period of time, the post had generated over 300 likes and 150 comments from Kenyans with their own tales of woe at the hands of PayPal.

” I didn’t know the post would attract so many responses. Many Kenyans are suffering. Paypal is using the excuse of online scams to take Kenyans for a ride and withhold their money”, the blogger says. “They can withhold your money for 30-180 days but there is no guarantee of getting your money even after 180 days. I know of people who have been forced to take loans to pay their bills after PayPal withheld their funds”, he adds.

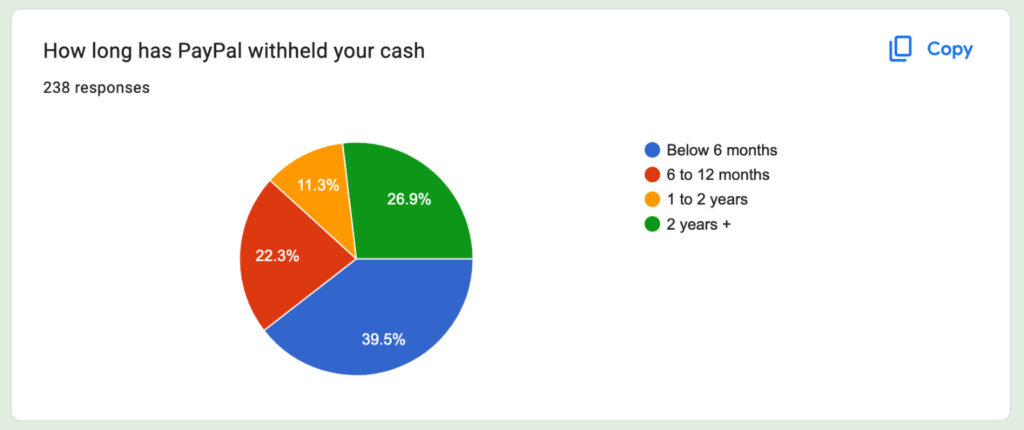

According to the users who responded to Gichuru’s Twitter call to action, 60% of suspended accounts have been in that condition for longer than 6 months. 38% have been blocked longer than 1 year, with a shocking 27% being blocked for longer than two years. In Gichuru’s case, his funds were withheld for three years.

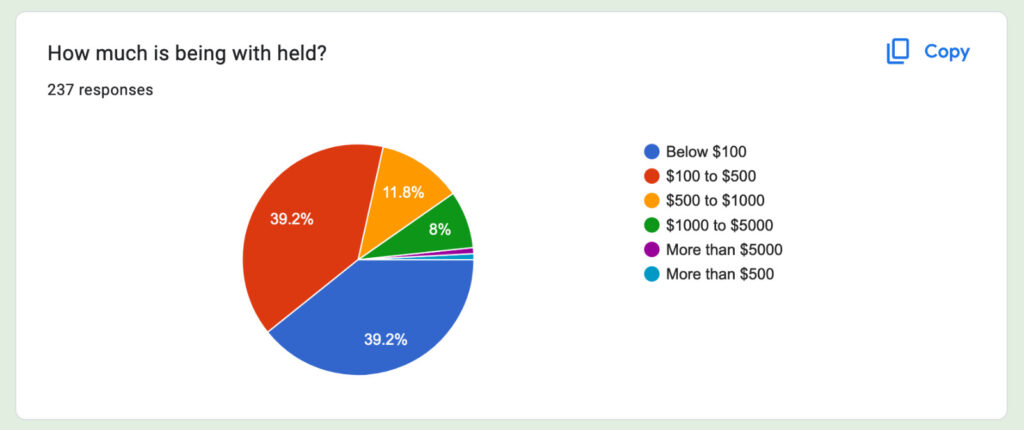

In addition, 51% of users are owed between $100 and $1000 by PayPal, 10% of users are owed more than $1000 and an elite group have been unable to access over $5000 being withheld by PayPal.

Impact of PayPal’s Actions

According to the Online Labour Index, Kenya has the second highest number of online workers in Africa after Egypt. With recent explosive growth of internet access in Kenya, and Kenya’s highly educated and internet savvy youth, it is possible that Kenya might well be host to the largest online workforce in Africa. According to the Kenya Private Sector Association (KEPSA), there are at least 1.2 million online workers in Kenya.

Thus, If PayPal’s tendency to withhold user funds is widespread and Gichuru’s figures reflect a trend in the wider population for Kenya’s remote workers, the impact on the Kenyan economy and on the livelihoods of millions of online workers is likely very great.

What is even more galling is that PayPal often refuses to explain itself when it suspends your account. Sometimes, they close it down entirely with your funds still in it. When that happens, many users have no way to appeal the decision. In these cases, the money is gone forever.

“PayPal just closed my account after waiting for 180 days. They told me that my money (about $1000) had been used to cover for damages”, one user laments. “They said I violated their rules without saying the exact rules I violated. I can’t remember violating any rule, she adds.

PayPal’s history is littered with examples of the company stepping in to freeze accounts over what look like minor infractions or totally innocuous reasons that are impossible to justify. While some users have given up all hope of ever getting their money, Sam Gichuru and Maina Ndegwa are using their online platforms to mobilize a massive joint action against PayPal.

With the support of the famously vocal Kenyans on Twitter (KOT), they might just succeed in forcing the company to finally pay up.

Your support empowers us to deliver quality global journalism. Whether big or small, every contribution is valuable to our mission and readers.