Kenyan Diaspora Sends Record Remittances Home in July

By KFP Editor

| August 21, 2024

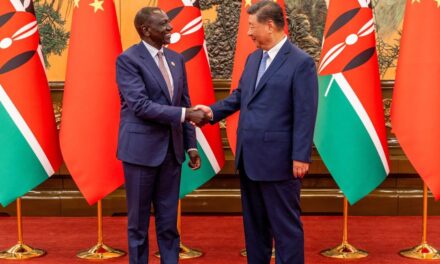

In dollar terms, the July record is the highest inflows the country has ever had and the new highest record for the year so far, after offsetting January’s high of $412.4 million. Photo: (Handout)

Kenyans living and working abroad sent home the highest ever remittance in July, marking the largest inflow so far this year, driven by easing inflation in the U.S., Kenya’s primary source of remittances.

According to weekly data from the Central Bank of Kenya (CBK), remittance inflows in July reached $414.3 million (Sh53.5 billion at the current exchange rate), up from $378.1 million (Sh48.8 billion) in July 2023, representing a 9.6 percent increase.

In dollar terms, this marks the highest inflow Kenya has ever recorded, surpassing the previous high of $412.4 million in January this year.

The easing of underlying inflation in the U.S. for the fourth consecutive month in July has resulted in more disposable income, allowing the Federal Reserve to maintain its trajectory toward lowering interest rates next month.

Several jurisdictions, including Kenya and the UK, have already reduced their base lending rates to alleviate the cost of living.

Earlier this month, the CBK lowered the benchmark Central Bank Rate to 12.75 percent from the decade-high of 13 percent.

In July, the U.S. remained Kenya’s largest source of remittances, accounting for 52 percent of the total inflows.

“The cumulative inflows for the 12 months to July 2024 remained steady at $4,572 million (Sh590 billion) compared to $4,076 million (Sh526 billion) in a similar period in 2023, an increase of 12.2 percent,” the CBK stated in its weekly bulletin.

“The remittance inflows continue to support the current account and the foreign exchange market.”

According to research by WorldRemit, Kenya is one of the continent’s top recipients of remittances, which are primarily used for household needs, healthcare, and education.

In recent years, Kenyans have also increased investments in the capital market and real estate, with the U.S., Canada, and the UK leading the way.

Last year, the CBK introduced the CBK DhowCSD, a web platform and mobile app that enables retail investors in Kenya and abroad to invest in government securities easily and conveniently.

The platform allows retail investors to participate in securities auctions, view auction results and payment details, check upcoming corporate actions, access updated portfolio statements, and initiate secondary market and pledge instructions.

The continued inflows have also helped support the Kenyan shilling, which reached a record low of Sh161 to the dollar in January, as the country faced a dollar shortage due to high demand from importers during that period.

Your support empowers us to deliver quality global journalism. Whether big or small, every contribution is valuable to our mission and readers.