Geopolitical Dynamics Shaping Kenya-USA Economic Relations

| June 17, 2024

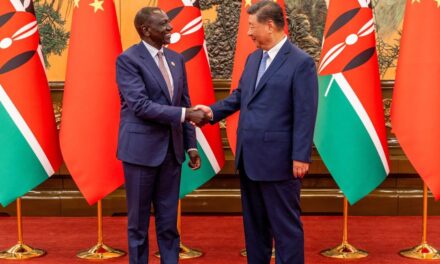

Kenyan President William Ruto (L) and US President Joe Biden shake hands during a joint press conference at the White House in Washington DC, US on May 23, 2024. Photo: Handout

President William Ruto was on a state visit to the United States where, besides the pomp and show, economic aims were expected to drive Kenya’s strategic interests in its engagements with the US.

However, these geo-economic relations between the two states appear shaky. This is due to inconsistencies and unpredicatability in trade ties owing to political outcomes in both countries, mismatch in priorities areas and strategic interests for each partner state, and shortcomings in engaging ordinary citizens.

First, the US stares at a very competitive election this year which portends geopolitical and geo-economic risks for any ongoing diplomatic negotiations.

Every transition of government in either state comes with volatility in economic policies. In 2022, the Biden administration launched the USA-Kenya Strategic Trade and Investment Partnership (STIP) and discontinued the Kenya-US Free Trade Agreement initiated under Trump and Uhuru governments in 2020.

Democrats believe that the government should regulate the economy. They tend to support government interventions to stimulate manufacturing and economic development. Contrary, Republicans opposegovernment spending and intervention in the economy.

They tend to advocate for a free market economy, and they are pro-business and international trade. The economics of the Biden administration (Bidenomics) has seen the US political economy shift from Trump’s trickle-down, free market and limited government role to building the economy from the middle out and bottom-up, market regulation, and heavy government investments.

Bidenomics is summed as: “the economy should be built from middle-out and bottom-up, not top down.” While Biden has driven investments in the green energy transitions, Trump has proposed to promote the productionof US fossil fuels.

A close analysis reveals similarities between Biden’s economic strategy and President Ruto’s economic model. Both have discredited the trickle-down model.

They seek to tax high earners to invest in infrastructural development and have stopped colossal tax cuts. Like the US, Kenya wants to release huge public investments (read affordable housing) to increase employment. Both are pushing for increased investments in green energy.

But this may change in case a new administration takes over in the US. Moreover, will Kenya’s economics ofBottom-up Transformation Agenda (BETA) outlive the current administration?

There is a mismatch in governance principles and areas of focus that facilitate commerce between the two states.

Kenya is more focused on economic diplomacy to have foreign direct investments by US

companies, diversify and expand trade opportunities, and spur digital and creative arts economies.

But the US appears to prioritise security and the geostrategic significance of Kenya especially in countering terrorism and enhancing defence cooperation in maritime security and peace operations in the Horn and Eastern Africa.

Whereas Kenya sees the US as a major trading partner, being the second largest export market for Kenya (Uganda is first), to the US Kenya is relatively not a major trading partner.

Therefore, this challenge of mismatch in the area of focus presents dilemmas in balancing economic aims, geopolitics, and defence and security interests.

The question is whether the current tantalizing Kenya-US economic ties are meant to establish a sustainable diversification of Kenya’s economic options or are simply an extension of US global geo-economics to contain China’s dominance of international commerce.

There are persistent shortcomings in awareness among traders and producers in Kenya about the scale and scope of opportunities that economic talks and ties such as the African Growth and Opportunity Act (AGOA) and STIP provide, especially concerning product spectrum and

local processing technical requirements.

Unlike his predecessors, President Ruto’s foreign policy is successfully managing to diversify trade and investment options by striking a balance with both the West and East powers while upholding its regionalobligations to EAC and the AfCFTA.

On May 9, 2024, a three-day China-Africa Economic and Trade Expo (CAETE), the first ever outside China, was held in Nairobi, Kenya.

The US-China geo-economic competition comes at a time when the 25-year-old trade legislation dubbed AGOA is expected to be extended for a further 16 years till 2041.

Notably, the renewed AGOA proposes to align its broader economic objectives with the AfCFTA. Overall, the US has recognized that a free market economy has advantaged rival non-liberal states such as China, hence the trade regulations.

As China accuses the US of a “technology blockade”, the Biden administration has intensified protectionism accusing China of “industrial overcapacity” that is decimating US industries by flooding Chinese imports.

As a long-time ally of the US, any economic and foreign policy shifts in the latter will most likely influence Kenya’s own economic and foreign policy orientations.

First, Kenya’s exports could be scaled down if the US ramps up a ‘Buy America’ policy. Also, America’s ongoing protectionist industrial strategy will reverse the gains of global economic integration.

Additionally, US trade relations could shift and concentrate on countries that produce critical minerals for the production of semiconductors. For example, US Vice President Kamala Harris visited Tanzania in March 2023, where she highlighted a project to be funded by the US that will be a processing facility on the continent for minerals that go into electric motor vehicles.

This enhances Tanzania’s regional competitiveness against Kenya. Nonetheless, the US renewed focus onlinking trade and climate presents opportunities for Kenya especially in clean energy and carbon credits trade.

Kenya should forge regional partnerships for the production and domestic processing of minerals that are key ingredients for the green energy transition.

This could be achieved through active leadership in AfCFTA. Likewise, Kenya should push for a faster conclusion of the ongoing STIP talks and equally re-align its economy to capitalize on opportunities in the proposed renewed AGOA.

The writer is a Research Fellow at the Global Centre for Policy and Strategy (GLOCEPS)

Your support empowers us to deliver quality global journalism. Whether big or small, every contribution is valuable to our mission and readers.